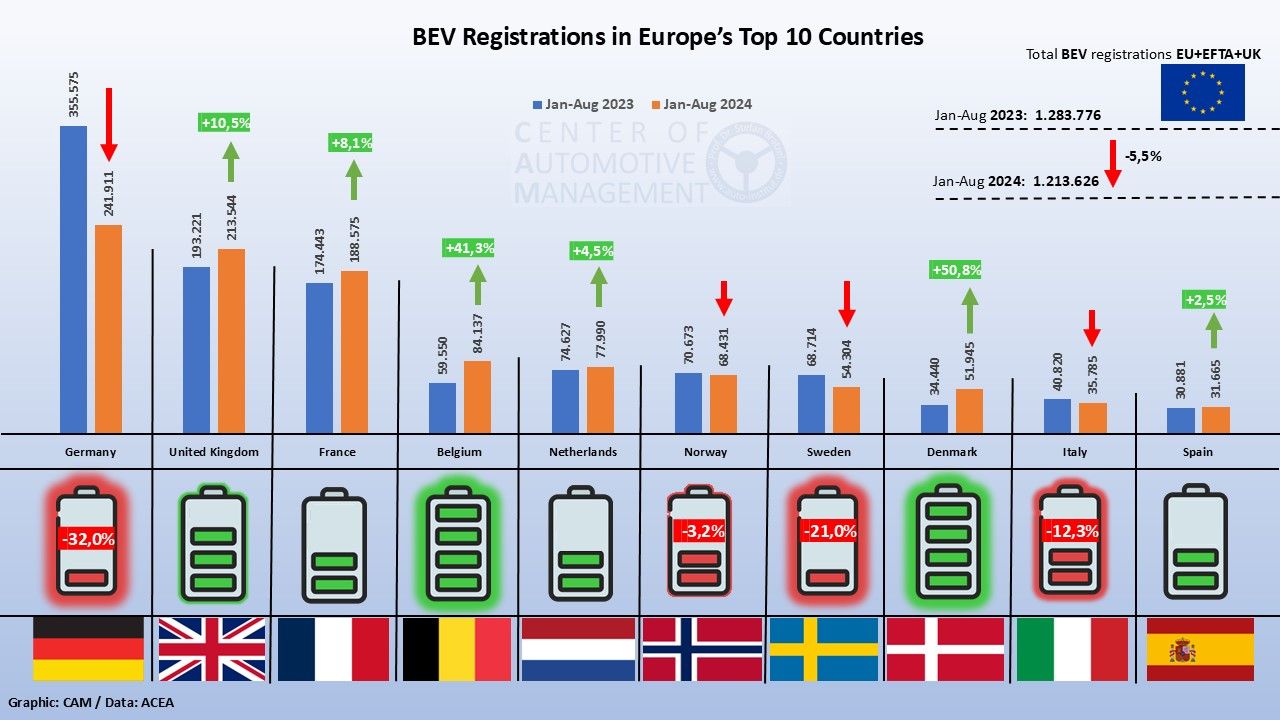

Specifically, 1,213,262 battery electric vehicles were newly registered in Europe between January and August of this year, CAM Director Stefan Bratzel wrote in a LinkedIn post. In the same period in 2023, there were 1,283,776 new electric vehicles. Under the heading “Europe”, the CAM summarizes the EU countries, the four EFTA countries (Iceland, Liechtenstein, Norway and Switzerland) and the United Kingdom. This is important because EFTA markets are also included in the calculation of manufacturers’ CO2 fleet limits! The situation is different for the UK, which has had its own regulation on carbon dioxide since leaving the EU.

Bratzel sees “big shifts in the European market.” In short, you can say that what sells less in Germany is now sold in other countries. “Although overall electric vehicle registrations across the EU, EFTA and the UK are down 5.5% compared to the previous year, there are conflicting developments in key markets,” says the automotive expert.

Most specialist readers will be familiar with the situation in Germany. From January to August, new electric vehicle registrations fell by a whopping 32 percent this year, with the rush ahead of the end of environmental bonus subsidies for commercial owners leading to a strong one-off impact in the summer of 2023 on the one hand. – And the sudden end of the environmental bonus in December at the beginning of 2024, which puts pressure on sales on the other hand. Either way, 241,911 electric vehicles instead of 355,575 vehicles in the same period last year represents a significant decline in Europe’s largest car market.

In contrast, “The UK showed strong growth of 10.5%, reaching 213,544 electric vehicle registrations. With this momentum, the UK is closing the gap with Germany and could soon occupy a leading position in the European market. If the situation in Germany does not change soon, The UK may soon become Europe’s largest EV market. France is now in third place (188,575 battery cars, +8.1%), and is also catching up, however, since markets such as Germany and France, unlike the UK, are relevant CO2 fleet from 2025, manufacturers in these markets are likely to ramp up their electric vehicle efforts soon – the recent price cut for the VW ID.3 is likely one such example.

It’s not just the three major markets that are seeing “remarkable developments,” Bratzel says. Contrary to what one might expect, it was not Norway or the Netherlands that took fourth place (in Norway, electric vehicle sales fell by 3.2 percent to 68,431 units in the current year, albeit with a very high market share of electric vehicles in the country in the current year). same time). Belgium even overtook Sweden with a 41.3 percent increase and jumped to fourth place with 84,137 electric vehicles – “an impressive increase,” Bratzel says.

The real jump will come in 2025

Among the top ten countries, Denmark recorded the highest growth rate of 50.8 percent. So far this year, Denmark has registered 51,945 new electric cars, compared to just 34,440 units last year. This means that the country only rose from ninth place to eighth place but is just behind Sweden (54,304 new electric cars). In Sweden – as in Germany – the new subsidy policy greatly affected sales, which fell by 21 percent from the previous year. Rounding out the top 10 were Italy (35,785 EVs, -12.3%) and Spain (31,665 EVs, +2.5%).

The main question now is how things will develop in the coming months. Ultimately, car manufacturers will be keen to meet their fleet CO2 targets and, at the same time, not sell too many electric cars. It is also expected that the sales actions and campaigns will ultimately result in approximately the same number of electric vehicles registered in the relevant European markets as in the previous year. A real jump is not expected until next year, as Peter Mock, President of ICCT Europe, impressively explains in our latest (German) podcast. Mock talks about “25 percent of vehicles being battery-powered” as an estimate — maybe a little less, maybe a little more. “This number will remain unchanged until 2029.”

LinkedIn.com