Residential retail electricity prices rose more quickly than commercial and industrial prices from 2019 to 2024, according to A study released last week By Lawrence Berkeley National Laboratory.

Nationally, average residential prices jumped 27% to 16.5 cents/kWh in the five years since 2019, while average commercial prices rose 19% to 12.8 cents/kWh and industrial prices rose 19% to 8.1 cents/kWh, LBNL researchers said in summary The report examines the factors that affect electricity prices.

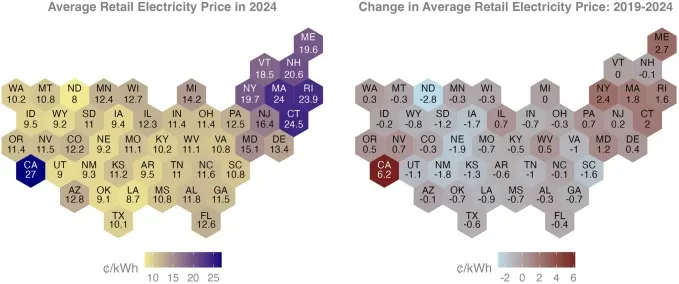

Overall, retail electricity prices fell in 37 states from 2019 to 2024 when adjusted for inflation, the researchers said. Because of costs associated with the wildfires, inflation-adjusted electricity prices rose 6.2% in California — the most among states, according to the report. Real prices in the Northeast also rose in the five-year period.

Optional caption

Last year, retail electricity prices ranged from less than 8 cents/kWh in North Dakota to more than 27 cents/kWh in California, according to the LBNL report.

LBNL researchers found that government energy policies can contribute to higher electricity prices.

“The states that experienced the largest price increases in recent years were typically characterized by shrinking customer loads — related in part to growth in net behind-the-meter metered solar — and had Renewable Portfolio Standard (REP) programs coordinated with relatively expensive additional renewable energy supplies,” the researchers said.

According to the study, states with RPS programs that called for new supply in the past five years increased retail electricity prices by about 0.4 cent/kWh. However, electricity prices appear to be unaffected by “market-based” utility-scale renewable energy projects built outside the scope of RPS mandates, LBNL researchers found.

Also, while solar cuts the net electricity load in some states — by more than 5% in California, Maine and Rhode Island, for example — it is associated with higher electricity prices, according to the study.

“Given the disconnect between pricing and cost structures under many net metering programs, and the financial cost of policy support, our regression results suggest that these load reductions were associated with increased retail prices for the broader customer base,” the researchers said in the report.

LBNL researchers also found that electricity prices charged by investor-owned utilities are higher and have risen faster than those charged by public power utilities. Overall, inflation-adjusted spending on distribution and transmission increased from 2019 to 2024 while generation costs fell, according to the report.

Overall, load growth has helped lower electricity prices in the past five years, the researchers found.

““It remains unclear whether broader and sustained load growth will increase average costs and prices in the long term. In some cases, increases in load growth could lead to significant increases in retail prices in the near term,” the researchers said.

Separately, Bank of America issued Friday report He said increased demand for electricity generation capacity and grid investments, driven in part by data centers, appears to be driving up electricity bills.

“Increasing electricity demand from data center development and manufacturing growth is already being reflected in prices for residential customers,” David Michael Tinsley, chief economist at the Bank of America Institute, said in the report.

Tinsley said the rate increases are driven by transmission and distribution system upgrades needed for data centers paid for by all ratepayers as well as higher power and capacity prices.

During July of this year, nationwide retail electricity prices rose 4.4% compared to the same period in 2024, according to the LBNL report. Meanwhile, pending rate hike requests — mainly from debt securities — have reached their highest level since the 1980s, suggesting that increases in electricity rates will continue, researchers said.

Hurricanes, storms and wildfires can raise retail electricity prices through short-term recovery and rebuilding, and long-term costs such as infrastructure hardening, operational expenses and liability insurance purchased by utilities.